The UPS Store®

Franchise Costs

Franchise Costs

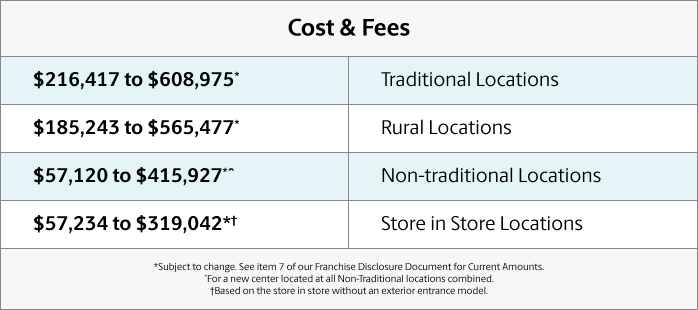

We know that franchising is a significant investment – both in time and money – and franchise costs can be a significant factor when finding the right franchise opportunity for you. That’s why The UPS Store® network offers a variety of opportunities and locations.

Table of Contents

Traditional & Non-Traditional

Franchise Locations

The price of owning a The UPS Store® center varies by store type, size and location. We have different price ranges for rural and non-rural traditional centers and non-traditional locations.

Learn More about Store In Store Opportunities

If you're interested in adding The UPS Store® services to your current business, find out how owning a non-traditional franchise opportunity can help build growth with best-in-class shipping and printing services.

Financing

Funding & Loans

The UPS Store® franchise does not offer direct in-house financing, but we can refer you to third-party lenders familiar to our brand and franchise model. These loans can help support franchisees with center upgrades and remodels, equipment leasing, and expansion into multiple center locations. We encourage you to investigate lending options from other lenders who specialize in franchise financing to ensure you receive the financing that best suits your business needs.

Can I Finance my The UPS Store® Franchise Ownership?

As with upgrades and expansions mentioned above, you may obtain financing to become a franchise owner and select the financial lender that best fits your needs. An approval letter from your lender will be required prior to the booking of your new center.

Special Cost Benefits

Tailored Pricing Initiatives

The UPS Store® special cost benefits to Veterans and First Responders.